The Changing Dynamics of Credit in California.

Real Estate Developers can benefit from the changing dynamics of Credit in California by connecting with both Traditional and Private Credit.

As many Real Estate Developers have experienced, the primary source of construction loans and credit in California has changed over the past 2 decades. It has been hard to quantify this shift, as I’ve financed RE projects for the past 7 years for Investment and RE Funds (providing Private Credit to Developers) and as an advisor & developer (organizing both bank and private loans for specific projects), So this summer, we decided to take a deeper dive into the data to see if Developers should consciously respond to the shift.

In my experience, it take a concentrated and substantial effort to share and receive loan terms from either source. In part due to time capacity constraints, Developers may have just 2-3 lender contacts that they get construction or perm loan LOI from. But as we will see, this strategy may leave a number of better financing options off the table based on the pure number of active lenders in the Market….

All permitted non-bank lenders, which I will refer to as “private lenders or collectively as private credit” receive a Lender’s License from the State of California. This provides important checks & balances and annual public reports based on individual reporting. Private Lenders are by definition non-bank lenders, and include Private REITs, Public REITs, Family Offices, Private Debt Funds and specific Construction & Bridge loan funds in addition to other categories of lenders…

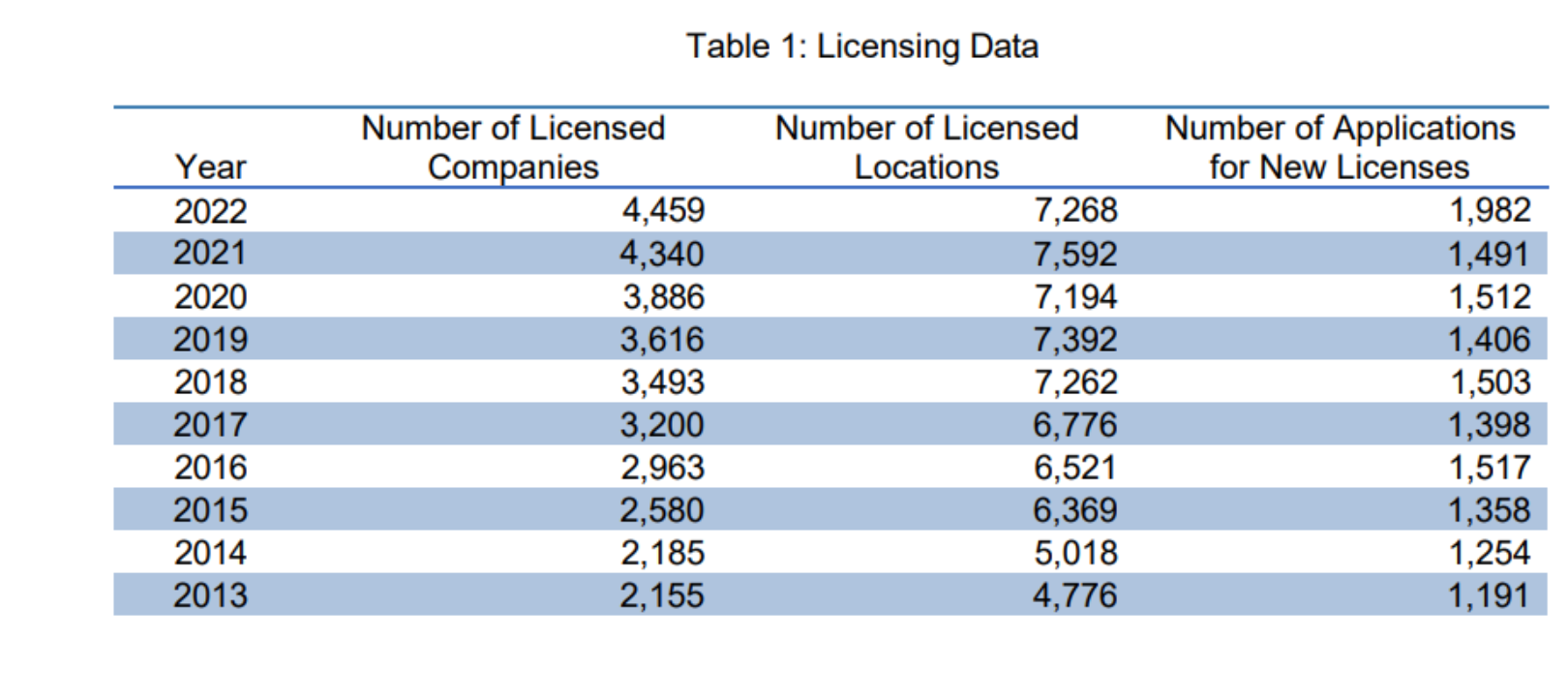

Astonishingly, as of 2022 (the latest year of public record) there were more than 4,000 licensed lenders in the State. And since 2013, the number of Licensed Private Lenders has more than doubled, marking the rise of Private Credit in California. Over the past Decade, New Private Lender applications are up 70%~ and physical Private Credit branch locations are up by 50%~.

Currently in California, there are more than 20 times the number of Private Lenders than Traditional Bank Lenders.

Simultaneously, the number of licensed lenders in CA more than doubled from 2,155 in 2013 to 4,459 in 2022 marking the establishment of private credit.

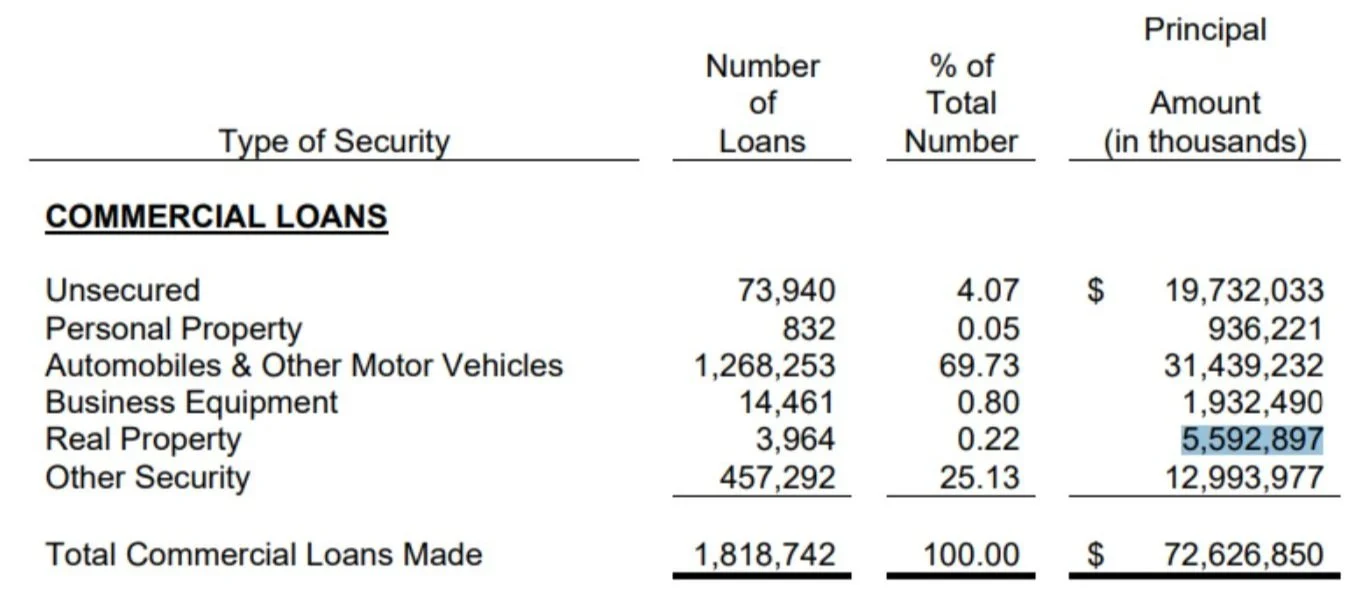

Private Loans Made or Refinanced in 2009

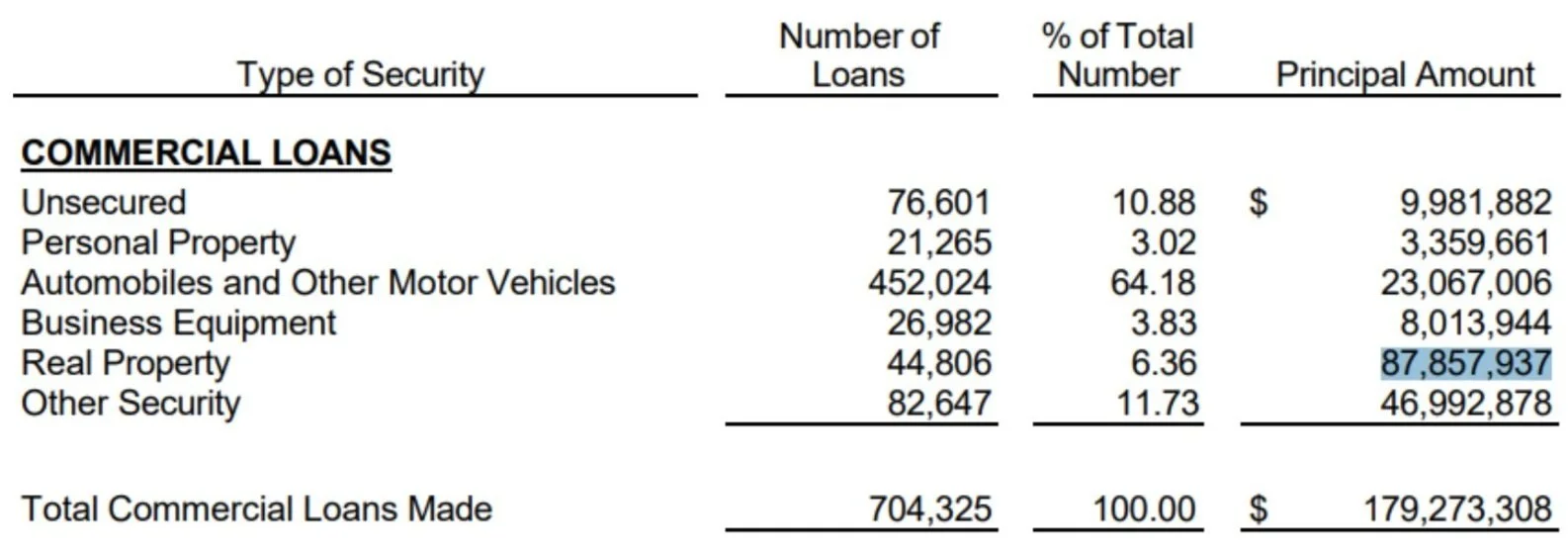

Private Loans Made or Refinanced in 2022

The figures are astounding, from $5.6B in debt secured by Real Estate that was issued in 2009 by Private Lenders and $89B in 2022….This is almost a 20 fold increase, which is reflecting the annual loans issued in a single year, not a cumulative increase.

But let’s look further at what’s happening to traditional credit - those Banks and Credit Unions that some say are impaired by regulations and bureaucracy. Some Real Estate Developers lament about how slow and particular certain bank lenders can be. Overall, the share of Bank lending in the U.S. has dropped to about 30% of the total commercial lending market. In 2005, there were 174 state-chartered commercial banks, but by 2023 there were only 99. Similarly in 2005, there were 217 state-chartered credit unions in California, and by 2023 that number dropped to 115. Simultaneous to the rise of Private Credit, there has been a massive consolidation of Traditional Lenders. Have you had one of your preferred construction lender announce a merger of late?

Certainly, some of the mergers announced over the past 18 months were a direct result of the 2023 Regional Banking Crisis, with California-based First Republic (which had a lot of RE Exposure) and Silicon Valley Bank toppling. In our experience, another impact of the regional banking crisis - is that Banks ask Developers for larger deposit relationships, sometimes even in non-interest bearing accounts. Regardless, the numbers show, the trend of traditional credit consolidation in California began more than a decade before.

On the flip side, we know a number of developers dissatisfied with the asset management service and draw request process of their Private Construction Lenders, which is why PartnerBuilt helps Developers get options from more lenders and provides our Clients with real time intel so they can make an informed decisions on Project Financing.

If you are a Real Estate Developer with an approved project and are looking for insights and to connect with additional financing partners, submit your Approved Plans at PartnerBuilt.com. We’ve reviewed over $1B of Ground up, or recently completed RE Financing Requests this year. We can’t help every prospective Client but we will schedule a call and provide insights…

Good Developers Deserve Better Financing

Dino Adelfio - PartnerBuilt

Dino Adelfio has organized more than $100M of real estate development projects across the great state of California. He’s also played a role in entitling over 450 units across 4-5 different jurisdictions. He has experience working on privately and publicly funded projects in both the commercial and residential space. Dino has more than a decade of professional experience in RE Development, entrepreneurship, and finance.

He has degrees or certifications in economics, public health and real estate. He originally received a CA Broker’s License in 2013. Prior to focusing his career on RE finance and development in 2018, Dino worked as the business development lead for an investment firm based in NYC, received a master’s degree from Columbia University, and organized urban planning projects in downtown San Francisco.

Dino’s also volunteered to organize vocational programs for High School Students through UC Berkeley, and has advanced legislation into State law that’s positively impacting thousands of residential development opportunities in California.

Dino founded PartnerBuilt in 2021 as a part-time consulting business to provide single clients with advice on acquisition, development and project financing; before launching full-time into the business in 2023.

CA DRE # 01925142